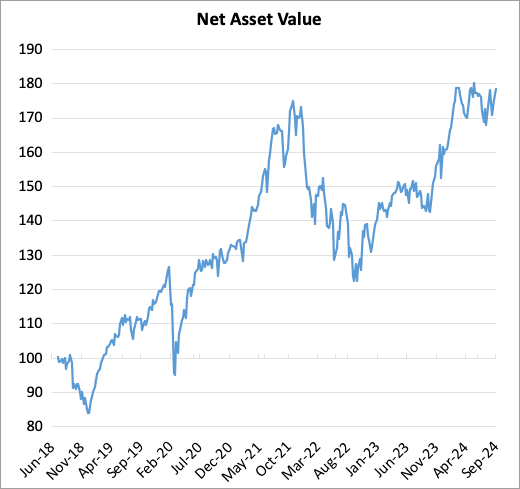

Factsheet: September 2024

Strategy

The Fund's objective is to achieve optimal capital growth over the long term through the active management of a portfolio of large-capitalisation stocks based primarily in a member country of the European Union or the European Economic Area.

The investment strategy is based on a fundamental analysis. The stock selection process is based on the activity of companies, their governance, financial structure, and development prospects. The fund aims to identify companies with dominant positions, high reinvestment capacity, and low debt.

The recommended investment horizon is 5 years. The reference currency is the Euro.

Markets

In a context of rate cuts announced by the ECB, European markets had a stable month, despite complicated global geopolitics. The Euro Stoxx 50 is up +0.86%, the Stoxx Europe 600 is down -0.41%, and the CAC 40 is up +0.06%.

Sector wise, the Basic Resources Sector led the charge at +8.73%, while the Healthcare Sector lost -6.46%.

The Fund

FFM European Selection ended the month (29.08.2024 - 26.09.2024) up +1.61%, outperforming all relevant indices over the same period, with the Euro Stoxx 50 up +1.34%, the Stoxx Europe 600 up +0.20%, and the CAC 40 up +1.32%.

The monthly top three consisted of Straumann (+9.92%), Alfa Laval (+6.29%) and Atlas Copco (+5.80%). On the other side, we find Novo Nordisk (-16.08%), ASML (-8.18%), and Ferrari (-6.15%).

During the month, we exited our investment in Dassault Systèmes and increased our positions in Air Liquide and Hermès

For more information, please email us: contact@fisconsult-sinews.com

Comments